This account has done well across the board with an average 3X ROAS. Search Campaigns and Smart Campaigns are the highest performing campaigns. The most obvious opportunities for improvement would come from shifting impressions and clicks over to search , where you are significantly more efficient in generating ROAS. Search Impression share was ~20% since the beginning of 2022 which means there is more opportunity out there on the search side. With that said, P Max Campaigns are going to be replacing Smart Shopping long-term and it is recommended to create and optimize these before the switch is forced on to your existing campaigns. We could also try some regular shopping campaigns that offer more complete control over targeting and demographics through bid adjustments.

Facebook Ads have produced typical results for the platform. The lack of backend conversion data tied to the campaigns and lack of maintenance to the campaigns are great starting points to transition into more effective Facebook and Instagram campaigns.

121M

1.02M

131,000

.084%

12.54

$3.24

$25.18

Year to date the account has generated 11.1M Impressions to generate 130K Clicks, resulting in 1,840 Conversion-Actions on the website. Total Ad Spend has been $219K to return 671K in revenue at a 3.02X Average ROAS for the account.

Click through rate is at 1.17% with 1.41% overall conversion rate. Search Impression share for this time was 19%.

In terms of network performance, Search Networks are generating the majority of conversions, 58%, while only generating 11.1% of impressions and 37.3% of clicks. Cross network sources account for 80+% of the total impressions served but only 41.4% of total conversions.

In terms of structure, There are 3 Smart Shopping Campaigns and 6 search campaigns. All Campaigns are using Max Conversion Target ROAS at Different Roas Targets ranging from 50% to 910%. All Campaigns are using all available networks, Search, Search Partners, and Display for Shopping and Search Campaigns.The Top ROAS campaigns are Search and Smart Shopping .

Contact Music City Digital Media to take your campaigns to the next level.

Devices may present an opportunity for improvement. The account is seeing greater productivity from desktop computers , 43% of clicks but 75% of conversions. Contrast this to Mobile devices which are more speculative in nature, occupy 51% clicks and 23% of conversion.

Contact Music City Digital Media to take your campaigns to the next level.

Ad Scheduling was found for Old Manual Shopping Feed and Video Campaign HYGGE for 5 AM – 12 AM, A handful (3) negative bid adjustments are in place on Friday, Saturday and Sunday for Old Manual Shopping.

Locations are targeting the US and Canada. Again the old manual shopping campaign has a handful of positive and negative adjustments for CA, NY , OR and Penn. There does not seem to be a consistent strategy with bid adjustments in this campaign.

Contact Music City Digital Media to take your campaigns to the next level.

Calls are enabled in extensions and some ad groups however the Advanced Bid Adjustment for calls is not enabled. Bid Adjustments in the account in general have been sporadically applied to a few campaigns but have not been used to enhance the Systems targeting of our high-converting ideal persona/network combo.

Branded Keywords are the stars of the keyword analysis. Branded Search Campaigns are the top producers and ROAS and as expected they have a great showing in the Keyword section; 3 of the top 10 include the brand name. The other top keywords are related to product description.

Contact Music City Digital Media to take your campaigns to the next level.

There are a number of Audience Segments in the account but not bid adjustments have been applied.

Conversions and Conversion Value are actively being reported back to the Ads account.

Contact Music City Digital Media to take your campaigns to the next level.

Smart Shopping Ads are being served the most and eating up most of the budget while Extended Text and RSA have the highest ROAS. The account has a large number of extensions in place, everything from Price to Callouts to Structured Snippets.

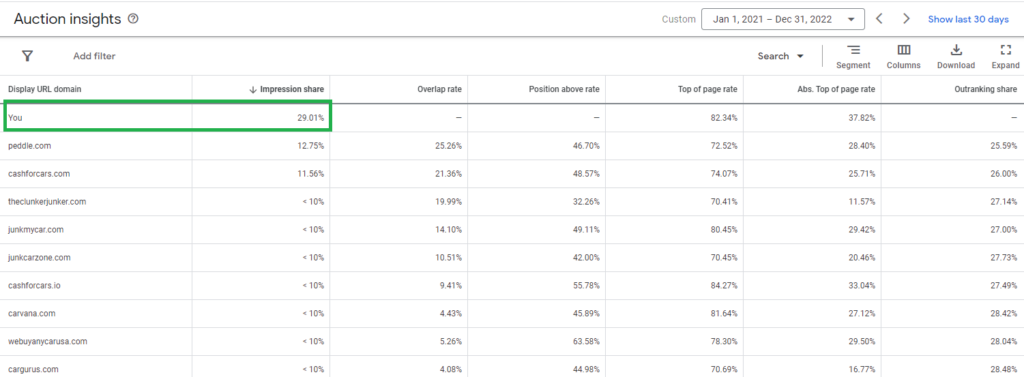

The account commanded the majority of the search market over the lookback period with 29%. Primary Competitors are Peddle.com with 12.75% and cashforcars.com with 11.56%. We also see the clunkerjunker.com, junkmycar.com, Carvana and car gurus.

Contact Music City Digital Media to take your campaigns to the next level.

Facebook/Instagram has a fairly diverse and well structured series of campaigns that showcase products and send traffic off-site to convert. In total we have an account with a total reach of 509K with 1.7 M impressions served. This resulted in 5,300 clicks to site for ~$5,800 in ad spend.

Almost all of the conversion rate rankings are below average and that needs to be addressed.

Almost all campaigns are set to the Highest Volume Strategy. Two of the Campaigns have not be edited in over ~2 years. Overall Ad Frequency is at 4.7, with the review campaign reaching 12.

Average CTR is 0.35%. Some campaigns have reached as high as 2%. CPC is $0.75 with 31,220 total clicks recorded. These are typical Facebook numbers for any industry. Offline Conversion Data is not available nor was any direct conversion value data found. Other than Shares and Likes, conversion value tracking is needed to provide a qualitative analysis of the facebook side of the sales funnel.