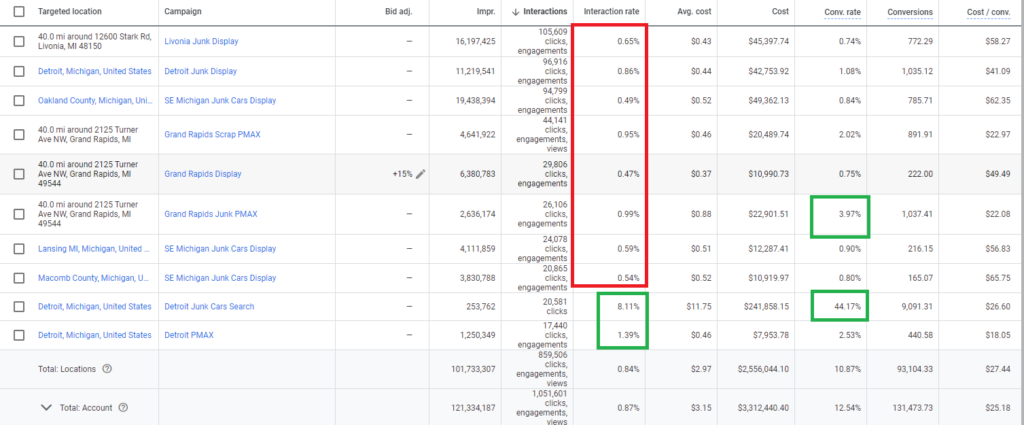

Qualitatively, it appears that the account has been shifting strategies over time. The results that have been produced thus far are adequate for the ad spend level but there is opportunity for improvement. Increasing CTR for the account can be easily accomplished by focusing on the Search Engine Result Page for ad distribution (although we do support P Max for general brand awareness) . We can also increase volume by casting a broader net in terms of Geographic Targeting and Ad Scheduling. Additionally there may be future volume from Electric Vehicle Recycling or Storm Damaged Recycling.

During the look back period the account generated 121 Million Impressions which resulted in 1.02M clicks to the website. Of those users brought to the website, 131,000 resulted in a conversion action. The total advertising cost during this time was $3.31 Million dollars.

Secondary metrics indicate that the click-through rate for the account was 0.84%. This seems like a fairly low click-through rate and is more indicative of heavy display and video structure rather than search. It does appear that you have previously settled on a search-first strategy supported by Performance Max for most of your target locations.

Conversion rate is registering 12.54%. This seems very strange to have a click-through rate so low and a conversion rate so high. It definitely seems like you may be over serving your impressions or perhaps casting too broad a net on the display network.

Cost per conversion is registering at $25.18, after reviewing the conversions we can see that it’s mostly form fills and phone calls that you are counting. This seems like a fairly reasonable amount to pay for the opportunity to purchase a junk vehicle. Average cost per click is sitting at $3.24.

One thing that jumped out at me was the search impression share during this time, that registered at 28.98% for the account.The account was dominant in these markets for these keywords by a significant margin compared to your competitors.

121M

1.02M

131,000

.084%

12.54

$3.24

$25.18

4 Active Campaigns present in the look back period with 3 Search and 1 Display campaigns. The vast majority of the spend has been in the “Search Terms and Phrases” Campaign with ~$61K. This campaign looks to be supported by a Display Retargeting Campaign called “New – Retargeting” . Both of these campaigns are set to Maximize Conversion, Google Search Partners is enabled on Search. In that time the account spent ~$70K to serve 4.21M Impressions, generating 108,000 Clicks to website and 1,500 conversions. The CTR on Ads was 2.57% and conversion rate was 1.39% , Average CPC was $0.62.

Initial thoughts are the account has been display heavy which has driven impressions and brand awareness but not necessarily conversion actions and leads. This may be typical of a niche scenario in this education / arts intersection we are pursuing. CTR and Conversion Rates seem just above minimum tolerance for performance. I like to see at least a 2% CTR and 1% conversion rate. CTR on Display New -Retargeting was 0.23% which is low , even for display. Likewise this campaign generated 4 conversions. The Search campaign has generated almost all conversion to date. Impressions are definitely display-biased but even the Search Campaign generated 1.5M impressions and had a 6.31% CTR which is Good, however the conversions rate should also be higher with that CTR. Landing Pages may be something to look at in terms of increasing overall conversions.

Contact Music City Digital Media to take your campaigns to the next level.

Device data may offer some interesting insights for us to use in the future, it appears that there is a combination of primarily mobile and desktop traffic to visit the site it seems that computers convert at a higher rate representing 24% of clicks and 41.6% of conversions there may be an opportunity for us to put positive adjustments on desktop devices to increase our exposure there and therefore increase conversions generated overall.

No bid adjustments have been found in on any devices locations, ad scheduling or audiences

Contact Music City Digital Media to take your campaigns to the next level.

The vast majority of locations targeted in these campaigns have been in the United States in North America although there are some International targets that are showing up that have served ads and generated clicks to website. There are also clear times of day where conversions are more likely to happen similar to a business-to-business or other professional search campaign. This is between 6AM and 6PM each day. No Ad Scheduling has been found on any active campaigns.

Contact Music City Digital Media to take your campaigns to the next level.

Keywords are relatively straightforward. Obviously service-based Keywords like acting schools, drama school, acting academy and similar are generating the vast majority of conversion actions from visitors. Specific school names and university names are also looking to be successful in this account and we recommend setting up a competitor campaign solely based on them.

Contact Music City Digital Media to take your campaigns to the next level.

Systems generated audiences have been found in use on the account however there are also other audiences that have been generated that do not have enough reach to be in play . Data Sources are actively building audiences through both GA and G. Ads.

Top performing add copy is screenshotted out below. I think it’s important to note that the LA acting schools ad group with the top performing with 569 conversions, other top performing add groups include the generic acting school ads and the New York-specific campaign. Pay special attention to the school names Campaign which had an outstanding 16.67% click-through rate and generated great results from limited spend. The top three ad types are all responsible search ads, however, there are also expanded text ads and display ads located in the account.

Contact Music City Digital Media to take your campaigns to the next level.

Conversions are set up in the account recording both contact form submissions as well as calls from ads we may want to add calls from website if they are not currently being tracked if you want I can do a Google analytics and Google tag manager review as well

Weekly Insights

Week of February 26 – March 4

End of Service.

Month of February

Top of the funnel was very consistent with what we did last month. 33,700 advertising units generated during the month which was more or less unchanged from what we did last month. Middle of the funnel saw about a 10% retraction in activity, minus 344 clicks for 3,120 users brought to the website from Paid ads this month. Conversions were surprisingly down from an otherwise Stellar couple of months over the winter, -51 for a total of 136 conversions generated. Advertising cost was unchanged from last month at $2,800.

Secondary metrics continue to indicate a strong and healthy account, click-through rate is sitting at 9.25%, while conversion rate did drop 1 point and is now registering 4.36% still a strong showing there although obviously not as good as we were doing previously. Not surprisingly cost per conversion crept up about $5 and is now averaging $20.56 per action while her average cost per click was up 9% for 90 cents per click.

Week of February 19 – February 25

Meeting 21st, Giving List of KW’s to be added to account. Sending Excel Doc.

Pausing Service.. Last Bill this month.

Added keywords this week that were sent over from Brad. They were added as exact match. This week we generated 8,150 advertising units which resulted in 751 users being brought to the website. Conversions were up about 8% from last week with 35 recorded. Advertising cost was down slightly at $673 in total advertising cost.

Week of February 12 – February 18

Looks like we are starting to level out here as we continue to make our way through february. The top of the funnel was oddly similar to last week’s numbers with eight more Impressions out of the account for a total of 8,540 ads served.

Clicks to the website however were down about 11%, -82 for 737 users brought in to the website this week. Conversions are where we are seeing the cooling in activity on the account, we did come in tied with last week at 32 conversions recorded.

Cost per conversion is still hovering around $20 per action. Click through rate for the month is at 9.18% while our overall conversion rate is at 4.18%.

On another note, I really cannot believe what is going on with the Morgan van lines.

Week of February 5 – February 11

Mixed results out of the account this week. The top of the funnel grew ever so slightly with about 600 more impressions for a total of 8,530 ad serve. mid funnel metrics show some growth with plus 104 users brought to the website for a total of $819 this week some good news there. conversions are where things start to disconnect, despite the increase in traffic and impression served we did see a drop of minus 6 in conversion production for a total of 32 conversions recorded this week. advertising cost also went up, plus $115 for a total of $712 in ad spend this week. Opti Pass on 2/7.

Week of January 29 – February 4

Coming out of the excellent month of January we’re seeing a dip in activity at the bottom of the funnel. We were -12 conversions this week for a total of 38. Top of the funnel and mid funnel metrics are continuing to produce. We see $7,880 ad served with the total of $715 users brought to the website. Ad cost has not changed from last week and is at $597.

Month of January

Looks like we had a really good month out of the AADA account. The top of the sales funnel showed some growth with 4,444 more Impressions than last month totaling 33,900 total ads served. We saw a commensurate increase in users brought to the site Plus 633 for a total of 3,470 users brought in from paid ads. Conversions were up 56 from last month for a total of 187. Total advertising cost was more or less unchanged from last month at $2,800.

Secondary metrics continue to indicate a strong account. We see our click-through rate sitting at 10.22% while our average conversion rate is up 3/4 of a point from last month at 5.40%, that seems to align with the increase in conversions coming out of the account. Cost per click is registering 81 cents.

Week of January 22 – January 28

50 conversions recorded this week. The top of the funnel is showing a very consistent 7,500 advertising units generated with about 10% of that resulting in traffic to the website. We saw 758 users brought in from Paid ads. Advertising cost is trending downward slightly, -42 from last week for a total of $632 this week.

Week of January 15 – January 21

We saw an excellent rebound inactivity out of the account this week. We picked up all the Impressions we lost last week generating 7,970 ads. Clicks to the website were more or less the same from last week at $781. the good news here is that conversions increase significantly plus 19 for a total of 51 I guess people have now woken up for the new year.

Week of January 8 – January 14

32 conversions recorded out of the account this week. Advertising cost is $630. The top of the funnel saw a slight decrease of 7,420 total ad served which was down about 575 from last week. We also saw a decrease in users brought to the site -66 for a total of 798. not super concerned as it is still early in the month and a lot of people are still coming out of the fog of the holidays.

Week of January 1 – January 7

Top of the funnel saw an increase in Activity with 1,560 more ads generated this week than last, for a total of 8,000 ads served. We also saw an increase in Clicks to the website, + 221 for a total of 864 users brought in from Paid Ads this week. Not surprising conversions increase on the activity at the top and middle of the funnel, +10 for a total of 35. Advertising cost was up 10% for a total of $657 in ad spend this week.

Brad has Comp Analysis coming. – Excel with 40-60 KW’s. -Competitors Names opportunity as well. 1/12/23

-Have launched Music Theater, May have a campaign dedicated for this in future.

-P Max Suggested at low ad spend.

Month of December

Not surprisingly we saw a bit of a slow down during the month of December overall.

Conversion production was down 21 from November for a total of 131 applications received from Google ads. The top of the sales funnel saw a predictable drop of about 10%, or 3,520 fewer ad units generated than last month. The total was 29,500 ads served. Luckily, clicks to the website held relatively steady, -25 for a total of 2,830 users brought to the site. Advertising cost was largely unchanged from last month, plus $3 for a total of $2,780 in ad spend.

Secondary metrics continue to look good on the account, click through rate is sitting at just under 10% at 9.61%. Overall conversion rate is still healthy at 4.62%, while our average cost per conversion is up about $2.96 this month, which is not unexpected with the Slowdown. Average CPA is sitting at $21.23. No change to the average cost-per-click at 98 cents per click.

Week of December 25 – December 31

Surprisingly we were +2 conversions this week from last, for a total of 25. Ad spend was also down on the increased conversion production, minus $51 for a total of $595 ad spend this week. Top of the funnel is holding very steady considering it’s the week after Christmas, 6,430 ads served no change from last week. Clicks to the website were up slightly + 44 for a total of 643.

Week of December 18 – December 24

Performance this week mirrored last week. Still down from the excellent start of the month. Conversions were down yet again, -4 for 23 this week. We haven’t seen conversions that low since September. Top of the funnel continues to shed a little volume with 6.4K Ads Served. Users brought to the website are down again, -53 for a total of 599. Advertising cost is up+$55 for $647 in Ad Spend.

Week of December 11 – December 17

Now we are starting to see typical seasonality that I was expecting last week, -17 Conversion for 27 this week. Top of the funnel showing sides of reduced organic volume with -500 Units for 6.5K total Ads Served. Clicks to the website are still holding however with -9, 652 this week. Total Ad Spend was down for the second week in a row, -$71 for $591 Ad Spend this week.

Week of December 4 – December 10

Spike in Conversion this week, +18 for 44 total. Nice to see here at the beginning of what is typically a very slow month for most verticals. Top of the Funnel was rock solid with 7K Impressions served, Clicks to the website increased +52 for 661. Total Advertising cost was up 10% for $663 in spend this week.

Month of November

It was a consistent month for the American Academy of Dramatic Arts account. Ultimately we were plus three conversions from what we were able to generate last month. 151 conversion actions were recorded. The top of the sales funnel decreased about 10% by 3380 ad units with a new total of thirty-three thousand ads served this month. That Resulted in 2860 clicks to the website. advertising cost was very consistent at $2,780.

Secondary metrics and the click-through-rate went up this month a whole point to 8.66% while our conversion rate was rock-solid at 5.28%. Almost identical to what it did last month. Cost per conversion is also very consistent right now down 50 cents for an average of $18.40 per conversion action figure Average Cost-per-click is also unchanged at $0.97.

Week of November 27 – December 3

-12 Conversion this week for 26 total conversions recorded from Google. Ad SPend was down $91 for $595 in total cost. Top of the funnel is holding steady at just under 7K Ad units served for the week. Users brough to the website were down slightly , -20 for 609.

Week of November 20 – November 26

38 conversions recorded this week with a total advertising cost of $687. Up about 9% from what we did Last week. Top of Funnel was relatively unchanged with 7,180 ad units generated. Clicks to the website were down slightly -44, for a total of 629 clicks to the website. Surprised to see a bounce here over the Thanksgiving weekend. I thought this was going to be our worst week of all with very low production, I’m surprised that actually went up from last week.

Week of November 13 – November 19

Top of the funnel introduced a little bit this week, -1,770 advertising units for a new total of 7,270 ads generated this week. Clicks to the website were down again -28 for a total of 669 users brought in from paid ads. Total conversions produced were down this week from last week for a total of 36. Advertising cost was $613 which was down $102 from last week. Looks like we’re starting to get a little activity in the account as far as moving closer to the Thanksgiving holiday.

Week of November 6 – November 12

Performance: Strong week this week with an increase of 8 conversions, with a 5% decrease in the cost per conversion; so overall a nice efficient week. Both impressions and clicks seeing increases as well (ads served + clicks to the website).

Notes:

Conversions up 25% (+8)

All CTS Submissions

Spend was also up 19% this week

Did generate 2% more clicks as well

Majority of conversions came through the main campaign, with 7 coming through the London 40 Mile test

Up 133% week over week for London specific

Week of October 30 – November 5

Performance: Spend down about 11% this week, but conversions actually up 3%. So overall a strong week – especially since this week involved halloween weekend. Softer time period around these months, so we’re happy to see a strong initial week of November right off the start.

Notes:

Conversions: 32 Submissions

London Targeting Test: was a little softer this week as we only finished with 3 conversions here and a slightly higher CPL, but overall still doing well

Our main search terms campaign had the lionshare of conversions with 29 (a 21% increase)

Acting Classes Near

Acting Schools

Academy of Dramatic Art

Month of October

Performance: October did great when we compare it to September. Our total conversions were up 8 with our spend staying steady. Our traffic to the website was also up, so overall costs for clicks and conversions were down (which we love to see).

Top the funnel was super consistent with overall production with 36400 advertising units generated during the month of October. We saw a slight increase to the overall number of clicks generated to the site with 2,790, plus 171 from last month. Call advertising cost was miraculously consistent, Plus $0.08 for a total of $2,800.

Top performing keywords remain unchanged from last month. The London campaign continues to produce a steady stream of leads.

Week of October 23 – 29

Performance: Nice overall jump in performance with 4 additional leads this week (15%) off of a 7% increase in spend.London campaign did really well this week with a big bounce back to 7 conversions. October as a whole is looking pretty good, especially with this nice final full week of performance.

Notes:

Conversions +15% (All CTS submissions)

Search Campaign: -8% for 24

London specific: +600% for 7

Overall Cost Per Lead down 6% to about $22 each submission

Top Terms:

Acting Courses

Acting Schools

Acting Classes Near

Acting Institute

Week of October 16 – 22

Performance: We did see a softer week this week come through our campaigns, but when looking at a wider view our October is still out performing the prior month so far. We are watching the campaigns closely to ensure this isn’t a trend and just a softer week in the market

Notes:

Conversions were down this week 29% (11 less)

Search: -5

Generic Search Terms (acting classes near, etc) saw the largest decline within this campaign as well

London 40 Mi Campaign: -6

Definitely a soft week here for London specific with only 1 conversion coming through this week for a CTS Completion Submission

Conversions overall for October so far are up 8% and costing us (on average) 9% less. So October still doing really well even with this most recent softer week

Week of October 9 – 15

Performance: This week was pretty consistent vs the prior week. Spend was down here about 6% so the matching decrease within conversions is fair / makes sense. We did see a dip of 3 conversions (7%), but we also saw our top acting KWs do well. Academy of Dramatic Art saw huge growth this week and had 4 conversions on it’s own.

Notes:

London 40 Mi Test did well this week with a slight lift in conversions, whereas the decline we saw this week stemmed from the main search campaign.

CTR Submissions -3 this week

Specifically the Scholarships NY was the main culprit this week

Spend was down 6% so conversions being down 7% makes sense (scaled)

Top KWs:

Acting Classes Near

Acting Schools Los Angeles

Academy of Dramatic Art

Acting School Near Me

Acting Institute

Week of October 2 – 8

Performance:

Notes:

Nice increases this week as our Conv Rates increased, Costs per Conversion decreased, and our overall conversion numbers increased as well

Great start to the month; spend was only up 6% and we achieved 41 conversions total (CTS Submissions: 41)

Top KWs:

Acting Classes Near

Acting Programs

Acting Courses

Acting Schools

No big changes based on the above data; traffic and conversions are moving in the right direction and we want to continue to monitor the campaigns, although we did comb through the search terms and ensure that we aren’t showing for anything irrelevant

Month of September

+14 Conversions for the month for a total of 140. Top of the Funnel was also up ~1800 to 36.4K Impressions , Clicks to site were also up +197 for a total of 2,620 users brought to the site. Total Ad Spend was $2,800 , no real change from last month there. Secondary metrics indicate that we had a 7.2% CTR and a 5.3% conversion rate. Good solid numbers. CPA is $19.97 with a $1.07 CPC.

Week of September 25 – October 1

Recommend installing GA4 via GTM on the website. Any Updated Customer Match Lists? Opti Pass September 25.

Week of September 18 – September 24

Conversions are down 2 weeks in a row. Were there any changes made to landing pages or are people coming out of summer and doing something else than look at schools? -12 Conversions from last week ( which was -8) for 22 total leads. Ad Spend was unchanged which is at least some good news. London Tests Campaign is holding steady at 6 which the domestic campaign was down 42%.

Top of funnel was actually seeing more overall impressions served and more users brought to the site at 677. This makes the conversion drop a mystery.

Week of September 11 – 17

This week we did see a slightly decline in conversions – especially after coming off the prior week (which saw a 75% increase in conversions). Spend was down this week about 13% do a decline was expected within conversions. Which off the 13% lower spend conversions were down 19% – so over the last two weeks still great numbers coming through collectively.

Both London test and the search campaign saw some slow down between the two. London did see a slight rise in costs per click; but still under $1 and lower than the main search campaign – so even with those lifts still a very healthy (low) Avg cost per click.

If we look at the last 14 days we see a 25% rise in conversions in total – so we’re happy so far with the London test and the overall direction of the campaigns at this time.

Week of September 4 – 10

Very strong initial full week of September as we saw a 75% increase in conversions off a 21% increase in spend. So not only did the campaigns ramp with spend (also saw a 15% rise in clicks/traffic) but the conversions positively scaled as well. So submissions were up which is great to see.

Both the London Test campaign and our standard search campaign saw growth – so again nice to see both growing in the right direction.

Month of August

Starting to see a little bit of a downward trend across the funnel. The overall number of impressions served was down about 10% by 3,020 units for a monthly total of 34,500 advertising that’s generated. Click the site were also down about 10%, mine is to 39 for a total of 2,420 clicks of the website. Bottom line conversions hold on now, we were only -9 from what we did last month for a total of 126 form submissions sent in from the website. Advertising costs unchanged at $2,770.

Secondary metrics indicate that our click-through rate is holding steady at 7% almost no change from last month. Conversion rate, no real change, sitting at 5.2%. Average cost per conversion is hitting at $22 per action, in my opinion that’s on the cheap side. average cost-per-click is sitting at $1.14.

MTD traffic data from Analytics looks like we’re sitting at about the 2 minute 27 second average view time with about a 54% bounce rate, on par or better than other channels. We also see that about 8.9% of all traffic during the month of August came from Paid Ads. Looks like you guys are doing some display there too.

Finally, I would like to note that while we were down slightly on form fills, if we are looking total conversions, in terms of other actions users can take to interact with the website, we were actually up 67% to 239 overall conversions.

Week of August 28 – September 3

-4 conversions week-over-week. Funnel is looking fairly stable as we move out of August and into September. Look for a month to date update soon. The top of the funnel is holding steady at 7620 advertising units generated this week. Total eclipse of site was down 35 for a total of 518 users brought to the website this week. Overall advertising cost was down about 10% to $580 in spend.

Week of August 21 – August 27

Optimization pass Tuesday.Plus 300 advertising units generated this week for a total of 7,870 ads served. We were -9 in overall users brought to the website for a total of 553 clicks. We were + 1 in overall conversions generated, for a total of 28. Advertising cost is unchanged at 626. London generated six this week.

Week of August 14 – August 20

Decrease in overall number of ad units generated this week. We were at 7,480 add units. Overall users brought to the site increased by 28 for a total of 562 users this week. We were -4 conversions week-over-week for a total of 27. Advertising costs remain unchanged at $625. The London test campaign had four conversions.

Week of August 7 – August 13

31 conversions week-over-week, no change from last week at all in terms of production. Overall advertising cost is also steady, down $8 for a total spend of $637. Top-level KPI’s very stable at this point. 7,890 advertising units generated this week, up 67 from last week. Overall Clicks the website, -26 for a total of 534. London campaign generated three conversions.

Top converting keywords this week were acting schools, the best acting schools, acting programs, acting academies, acting schools.

Week of July 21 – August 6

-4 conversions week-over-week for a total of 31. Advertising costs were unchanged with $645 and advertising spend. Top-level performance indicators are holding steady, we saw a slight reduction in overall number of ad units served, -828 for a total of 7,820 ad units generated this week. Over all users brought to the website was down slightly -34 for a total of 560 this week.

Month of July

This was a great month for the account. Looking at our top-of-funnel metrics we see an increase in the total number of advertising units served, +6744 a total of 37,500 units served this month. That produced an increase of about four hundred clicks to the website month-over-month for a total of 2,660 users brought to the website from Paid ads. Those users engage in 45 more conversion actions month-over-month for a new total of 135 conversion actions recorded during the month. Advertising costs increased during this time about 10% from what we did in June, plus $280 for a monthly total of $2,800 in advertising cost.

Looking at our secondary KPI’s as we see that our click-through rate is unchanged, holding steady at 7.09%. Not surprisingly we saw an increase in the overall conversion rate, plus 1% for a total of 5.07% during this month. Also not surprisingly cost per conversion dropped thanks to the increase in conversions generated on the website, that’s now sitting at $20.71 per conversion action. Average cost-per-click is unchanged at $1.05.

The majority of conversions came from our primary search campaign with 129. The London test campaign generated 14.

Week of July 24 – July 30

End of the month on a strong note, plus three conversions week-over-week. We saw a slight decrease of about 10% to the overall number of advertising units served, we generated 8,650 units this week. Overall clear to the website where down 37 for a weekly total 594. / advertising cost was down $20, a total of $630 this week.

Week of July 17 – July 23

+1 conversion actions week-over-week. Total of 32. Advertising costs increased slightly by $50, for a total of $651 in advertising spend this week. Overall Clicks to the site were up + 18 for a total of 631, the overall number of advertising units served were also up 1,400 for a total of 9,470. Interesting to see this uptick in activity right before school starts. Maybe there’s a correlation. 7 conversion actions came from our London test campaign, I think that’s the best of its done so far.

Week of July 10 – July 16

Continuing to see a steady stream of conversion actions come out of the account. + 2 conversion actions week-over-week for a total of 31 this week. Overall ad spend is down $53 for a total advertising cost of $600. No major change to the number of ad units served at 8,030. Overall number of clicks to the website increased plus 14 for a total of 613 this week.

4 conversions from our London test campaign. Meetings cleared for the next couple weeks.

Week of July 3 – July 9

Steady performance out of the account this week. No real change to the overall number of ad units served -223 for a total of 7,880 ads served. Clicks to the website were up about 50 for a total of 600. Total conversions were plus to 4 total of 29. Advertising cost has not changed and is remaining very steady week-over-week for a total spend of $653. Click-through rates on the ads are actually up 8 tenths of a point for a total of 7.61 per cent. Conversion rate is holding steady at 4.8% cost for conversion is sitting at 2252 no real change there. Average cost-per-click is down to $1.09.

Month of June

From some perspectives June was the most efficient month the account has had. Overall Ad Spend was down 50% Month over month and the majority of our KPI’s are reflecting that, however, the silver lining here is that total conversions are down only 34 for a total of 90 this month. Total Impressions were down 16K for a total of 30.8K. As expected Clicks to the website decreased approx. 1100 to 2,260 clicks. CTR is holding steady at 7.35% and conversion rate is also steady sitting right at 4%. Average CPA is down to $27.96. Average Cost Per Click is sitting at $1.11.

The London test campaign has been sending a steady stream of leads since it started. Specifically we have had 536 Clicks to site and 14 conversion actions. CPA Here is sitting at a very similar cost of $33. Total spend this month was $465.

Week of June 26 – July 2

Pulled some Reach Planner Data for projected costs and reach/views for our Audience.

The account is on the mend this week, +5 conversion for 27 total. No major change in Ad cost with $654 spent . Clicks to the website were +5 to 550. Impressions were steady at 8100.

Week of June 19 – June 25

Optimization Pass on account, Bid Adjustments added to Audiences. Send Links to Specs and send Summary of Descriptions and Headlines as well as Best Practices.

Account performance was up mostly. The overall number of ads served increased 609 to bring us to 7,720 Impressions served. Conversely we saw a slight dip to the number of clicks to the website -29 bringing us to 544 clicks this week. The number of overall conversions was up, plus three, bringing us to 22 conversions for the week. Overall ad spend was spot-on at $621. Conversion rates are sitting at 4.04% which is good, or click-through rates are steady at 7%, no major change to our cost for conversion sitting just under $30 at $28.23. And finally our cost-per-click is relatively unchanged at a dollar in $0.14. Looks like our London campaign is still up and running but we are not seeing any major action from it with 3 conversions this week.

Week of June 12 – June 18

Account performance this week was consistent with last week. Overall impressions served came out to 7110. Down slightly from the week before. Overall clicks to the website were up plus 16 to bring us to 573 for the week. Overall conversions were consistent with last week -1 to bring us to 19 for the week. Same goes for overall add spend which came out to $619 up $15 from the week before.

The London test campaign generated one conversion this week.

Week of June 5 – June 11

Resumed US Campaign on Monday per Brads follow up email. Add performance this week saw some increases. overall impression serves grew by about 2300 for a total of 7600 impressions for the week. Overall clicks on the website also increased to 557 for the week. Overall conversions were plus 7 for 20. overall add spend with $604, plus $123 from last week. Click-through rate was down half a point while conversion rate was up half a point, Which is a trade i will take. Cost per conversion was down to $30.22 per action .

The London test campaign is falling Within These parameters with a 2.96% conversion rate and a 7.62% click-through rate. We have seen 4 conversions from this campaign this week.

Week of May 28 – June 4

June 2- Removed London KW’s, Double Checked Budgets and Paused US Campaign for Summer. Only current Active Campaign is the London Test @ $16/day / ~ 489.4 / Month.

It appears I misunderstood our plans, my understanding was that we were only running the London test campaign over summer. This is why I deactivated that US based search campaign. This is what’s causing us to see a big dip and conversions as well as overall add spend and top of funnel KPI.

Still too early to see results from the UK test campaign.

Month of May

Account performance was improving prior to budget reductions. Total Impressions served were down to 47.5K while total clicks to the website were also down to 3.6K. The good news is that overall conversions were still up to 124 (+28). The changes to the langin pages are definitely performing better and those changes should be kept.

This month we also discussed our London test campaign and noted the specifications for that campaign. Our London test campaign was launched on June 1.

Week of May 22 – May 28

Brad pulled budgets back to ~$75/day . Meeting Thursday. Discussed email items and the test Campaign to be set up by Tuesday of Next week. Account performance saw a dip in overall impressions, clicks to site and conversions. Ad Spend was also down under $1000. So definitely we can attribute some of the decreased performance to the decrease in overall ad spend.

Discussion of Test Campaign for London @$16/day

Client gets a lot of UK Traffic

50 KM Radius or 40 Mi

Interested in Acting, School in US,

Add US or American in front of Existing KW’s / Acting School NY , Acting School LA.

Stand Up – Search Campaign, Same Conversions, Same Landing Page.

-ASAP Launch , No End Date.

Week of May 15 – May 21

It looks like the account is leveling out nicely, KPI’s have settled and produced almost identical performance to last week. Conversions are consistent at 32, Clicks steady at 802 and impressions were +234 to 12k.

CTR was 6.69% and Conversion Rate is at 3.99%. So Ads are resonating with the searchers and the landing page is back to converting at a decent clip. Discussion of account throttling later next week.

“Acting Schools, Acting Classes near, acting programs, acting college and virtual acting lessons” were the top producing keywords this week. Impressions share data is still NA.

Week of May 8 – May 15

Optimization Pass. Steady performance for top of funnel metrics, +5 conversions week over week to 32 for the week. Total Ad Spend was $1,300. Conversion rate is up 0.90%, which is great news for the landing page optimization test results. CPA is down to ~$40 with a $1.62 CPC. Good news for everything.

To Recap our discussion from this week we are going to be entering a holding pattern/reduced ad spend level for summer as we are an Academic vertical. There may be some testing in secondary markets, the UK, and some test campaigns designed for this over summer. TBD officially.

Week of May 1 – May 7

Good News! It looks like your optimization fix worked. Full point higher in comp of last 10 days versus previous 10 days. It also looks like lifting ad scheduling was a good idea as the 12AM-6AM block is definitely showing activity again. +11 Conversions despite ~1.5K fewer impressions, Same number of clicks to site and equivalent ad spend. CPA back down to sub-$50.

CTR and Overall Conversion rate are continuing to buoy and mating a positive trajectory from the last couple of weeks.

Month of April

Landing page tests during April may have skewed the account KPI’s to look like a mixed bag of results. Ad Spend, CPC and Clicks to site were stable month over month but everything else changed. We were down ~12K Impressions to 54.6K, down 56 Conversions to 88 for the month.It is likely that the changes to the landing pages are impacting the end of funnel actions. CTR is holding steady at a high 6.7% while overall conversion rates have dropped to 2.4% from 4% previously.

Week of April 24 – April 30

Meeting Thursday. Eric Out of Office until May.May 1st making tweaks to Landing Page.

Has 3 different customer match lists. ~20k list coming. Setup RDA’s once the list arrives.

Fiscal Year start September, Sept-Dec heavy acquisition time. Reduction in Ad Spend coming.

Account performance was great this week with an increase in all KPI’s. +12 Conversions to 23 for the week. +106 Clicks to site to 892 and +2.8K impressions to 13.9K. CTR’s are holding steady at 6.4% which is excellent. Conversion rate for the month was up over a point to 2.58% , CPC remains unchanged at $1.61.

Week of April 17 – April 23

Meeting Monday. Will find out if approved to add UK. Despite removing Ad Scheduling limitations , we still saw a 50% decrease in conversions coming from paid search. Impressions and Clicks are holding relatively steady with very minor decreases in both. Ad Spend was also down slightly but it appears that landing page adjustments are causing users to be more selective in submitting an application. CTR this week actually rose half a point to 7.11% while Conversion rate dropped 1.22% to 1.4% (~50% drop). I will leave it up to you guys to decide if the quality trade is worth the volume drop.

Week of April 10 – April 16

Removed Ad Scheduling (4/13) from the account, I feel like we are missing opportunities on the back side of the clock with creative types that like to stay up late. I compared my data with the all time data and there is definitely enough activity to justify running all the time, so I reversed that change. Ideally this will buoy conversions and get our CPA’s stable or going back down.

-2 Conversions week over week, which is way better than the -10 conversion two weeks ago, definitely picked up a couple of conversions outside of previous ad scheduling hours so it looks like taking that off is already helping. Impressions and Clicks down slightly but looks like we are consistently in the 800-950 clicks/week now.

Week of April 3 – April 9

Optimization Pass made. Seeing a little bit of a rollercoaster to account performance the last 2-3 weeks. Impressions were up slightly along with clicks to site but overall conversions were down 10 from last week. Ad Spend was also up slightly but an additional $150. CPA’s up to $56. CTR’s are holding steady, so we are still reaching the right audience and they are liking what they see in the headlines and description but just not biting as much as they were previously. Have any changes been made to landing pages? Search Impression shares data still NA so we can’t see competition other than the usual nyfa.ed and nycda.edu.

Top performing keywords have not changed, MTD Ad Spend is $2,200.

Month of March

-15 Conversions Month over Month to 144. Conversion Rate up to 4% now but also seeing increase in CPA and overall ad spend. March spend was $5620. Impressions were down 36K but clicks to the site were up to ~3,500 for the month. Looks like a better target for the ads and more resonance with our audience as our CTR is up 2.5% to 5.36% for the month. Despite the increasing CPA I feel like these are all good indicators and we should be seeing quality leads at the bottom of the funnel.

Analytics is reporting increases from almost all traffic sources. Paid was +23%, Display +25%, Direct +17%. Social is the only source down by ~30% month over month.

Week of March 27 – April 2

Meeting Thursday. Potentially expanding Search into the UK/Euro. Customer Match List coming. +11 Conversion week over week so a bit of a roller coaster from the conversion perspective over the last 2 week. We are seeing increased Conversion rates up to 3.8% , CTR up to 7.2%. Ad Spend relatively stable week over week at ~$1200. Clicks to site up to 885. Hopefully this will keep up.

Week of March 20 – March 26

Optimization Pass , Crated Dynamic Search Group as a test, Bid Adjustments on Devices for Computers (+25%), Locations (NY and CA +25%). Added Ad Scheduling, Image Extensions, Keyword Optimization. Want to follow up on the Conversion Tracking check , was I approved to do that as well?

In Terms of performance we are seeing a mixed bag of results that don’t yield any qualitative data on the leads themselves. Quantitatively we are seeing a reduction in overall conversions and increase in CPA. Overall Ad Spend was also ~$200 less than the week before. Account changes made on the 21st included positive bid adjustments on our ideal demos, ad schedules and more keywords. These metric shifts may indicate a better pool of candidates despite being a lower overall volume. The increase in CPA may also reflect this.

Contrasting this opinion is that ad scheduling may be overly restrictive and filtering out too many late night / early morning searches and conversions . Need more data.

Week of March 13 – March 19

Started Implementing changes from Audit. Ran into a roadblock with read only access. Reached out and access was upgraded by Eric. Still need to send out invites for recurring meetings and do the initial optimization pass.

Week of March 6 – March 12

Approved to Manage Account at 2 Hours per Week @$75. Creation of Command Central Document. Setup of Recurring Meeting every ~14 days with Eric in Progress.

Need to Discuss Budgets.

February 27 – March 5

Meeting with Brad and Eric to review Audit and discuss recommendations.

Month of February

Account Audit Completed and Delivered.