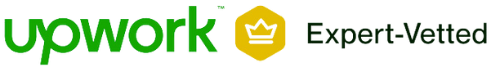

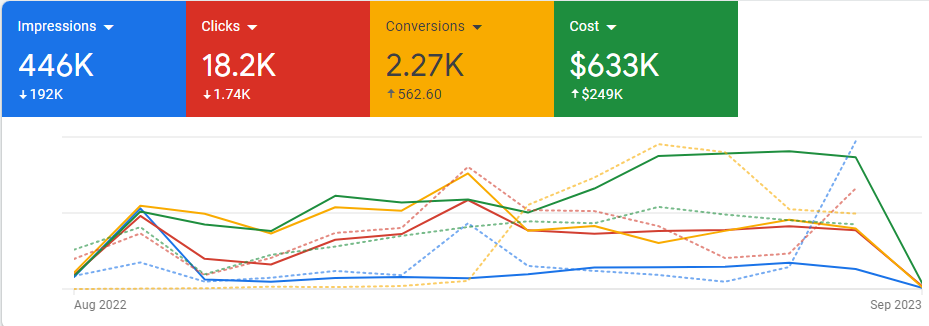

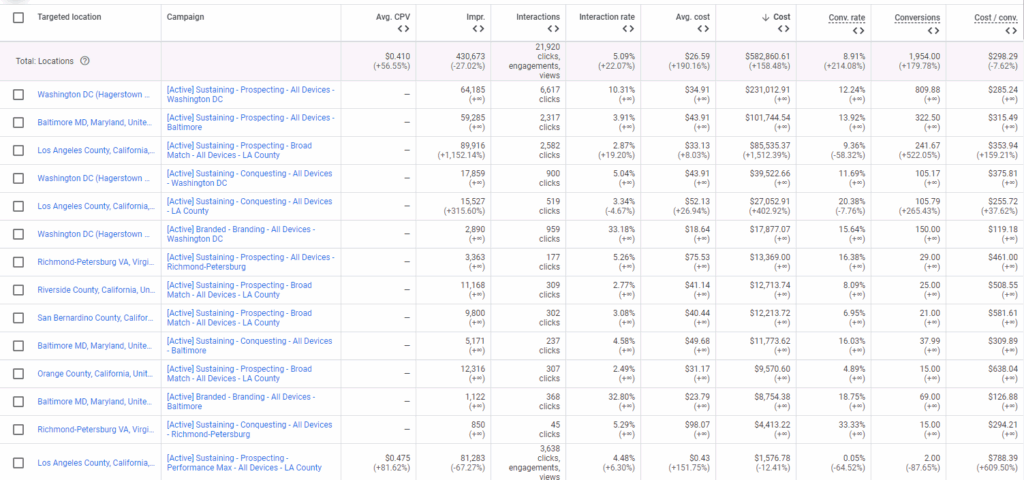

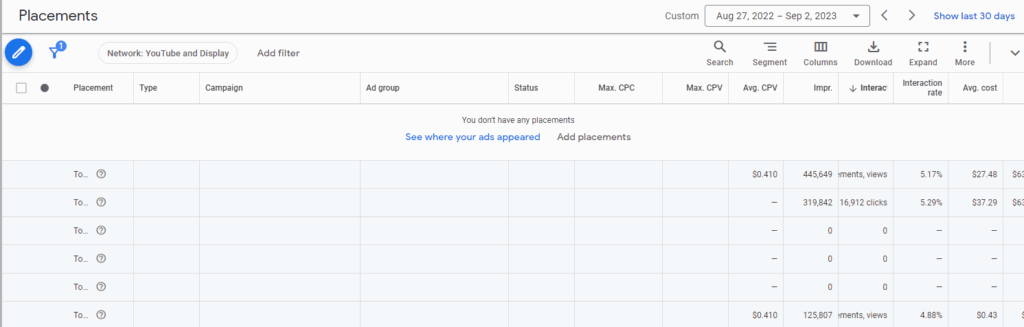

As requested we’re looking at the last year of account data going back to approximately August 2022. With that in mind, we can see that the account has generated approximately 446,000 impressions which resulted in 18,200 users being brought to the website. That comes out to an approximate 4% click-through rate at the account level.

For reference we like to see a minimum of 2% click rate and conversion rate for all things related to Google Ads, especially search and your account is exceeding this minimum. A 2023 benchmark of key performance indicators by industry is available from SEM Journal and I am including a link to it here for your reference.

Of the users brought to the website, approximately 2,270 resulted in a designated conversion action. That comes out to a conversion rate of 9.85%. Assuming the conversions that you have been recording in the account are valid lead capture conversion actions, this would be categorized as an excellent conversion rate. Average cost per acquisition is registering at $279, which is a fairly reasonable price to pay for the opportunity.

Total advertising costs during this time was $633,000 with an average cost per click of $34.86.This is a very expensive vertical in the cost per click is not at all surprising.

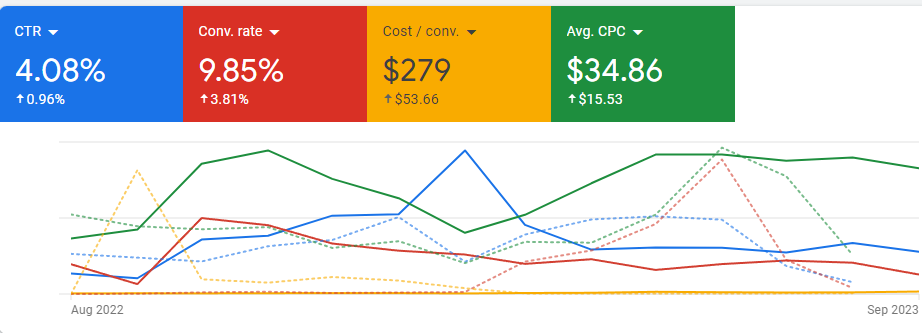

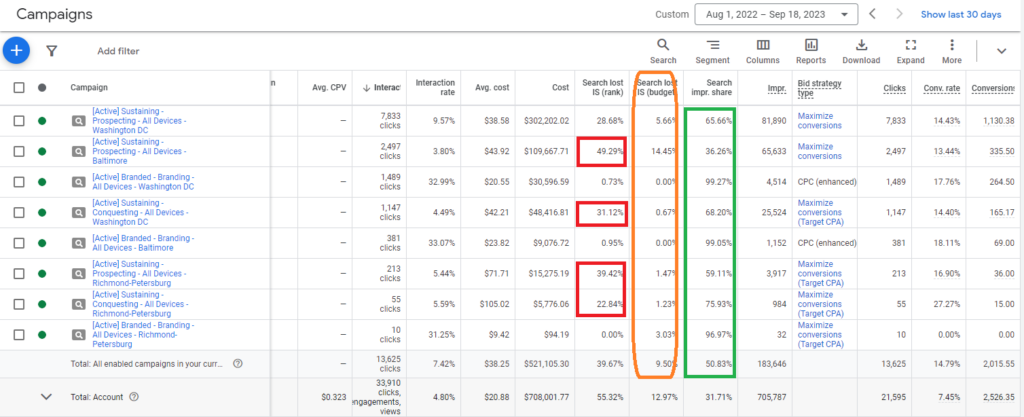

A couple other important metrics to look at are the overall search impression share which was 31.31%. That is an excellent search impression share considering most of these campaigns are competing in several large markets, Most notably Washington D.C. We do see conversion value being reported back into the account has registered $240,000 , however, it does appear that this is primary lead generation and all offline conversion data is not making its way back here 100%.

446,000

31.31%

131,000

4%

9.85%

$34.86

$279

Click through rate and conversion rates appear healthy across the board with mid to high double digit conversion rates as well as high single digit click-through rates on active search campaigns.

Contact Music City Digital Media to take your campaigns to the next level.

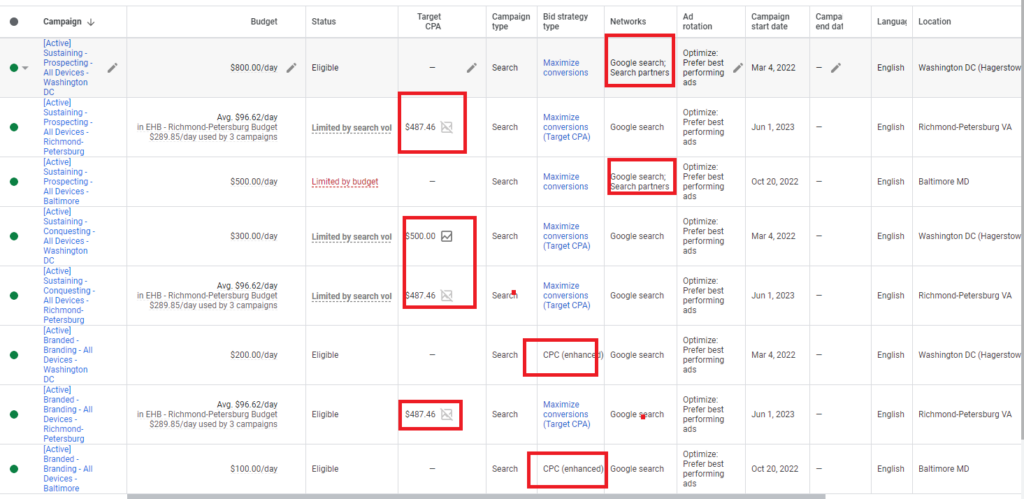

There are a couple campaigns currently opted into the Search Partners Network. The Search Partners Network represents other third-party search engines and search result providers that is not the same as the Google search engine results page. Ad rotation optimization is enabled for all active campaigns.

I wanted to take a second to talk about Target Cost Per Acquisition as well as Cost Per Click enhanced bid strategy. Starting with cost per acquisition, it appears that targets are set to approximately $487 to $500 per acquisition, in comparison to the account history which has a clearly defined historical average cost of around $280. I am wondering why the TCPA here is set to almost double what the account history says a realistic cost per acquisition should be. Also in my experience, you have more than enough budget to be generating quality leads at the $280 cost for acquisition level. $480 is closer to Personal Injury or other legal related CPA.

Talking about Cost Per Click bid strategy, to be blunt that is an outdated and antiquated bid strategy that does not take advantage of contextual data. If the computer does a handful of things really well it is managing the bid process in defining cost per clicks for us so that we can spend our time in more productive areas of account management. I recommend moving away from CPC bid strategy entirely using maximized conversion or a derivative strategy (TCPA).

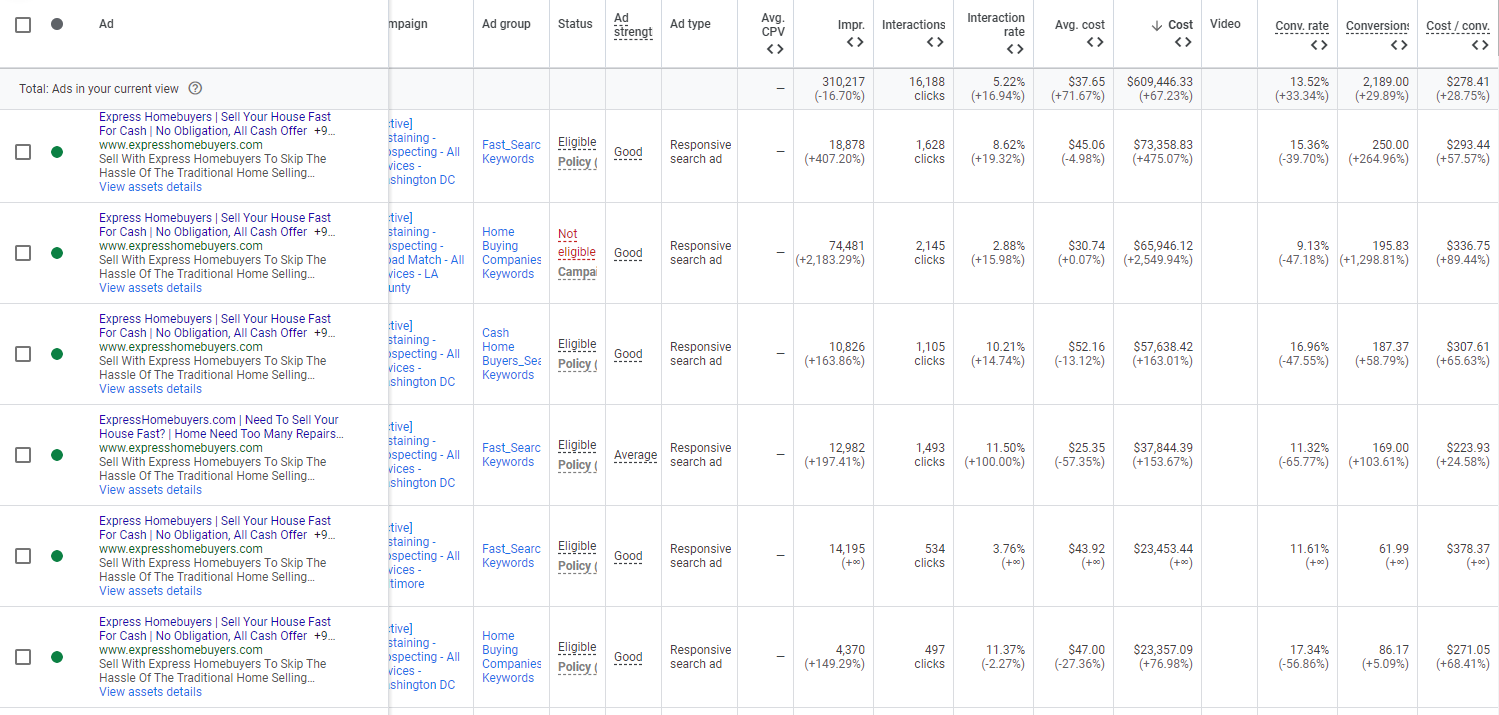

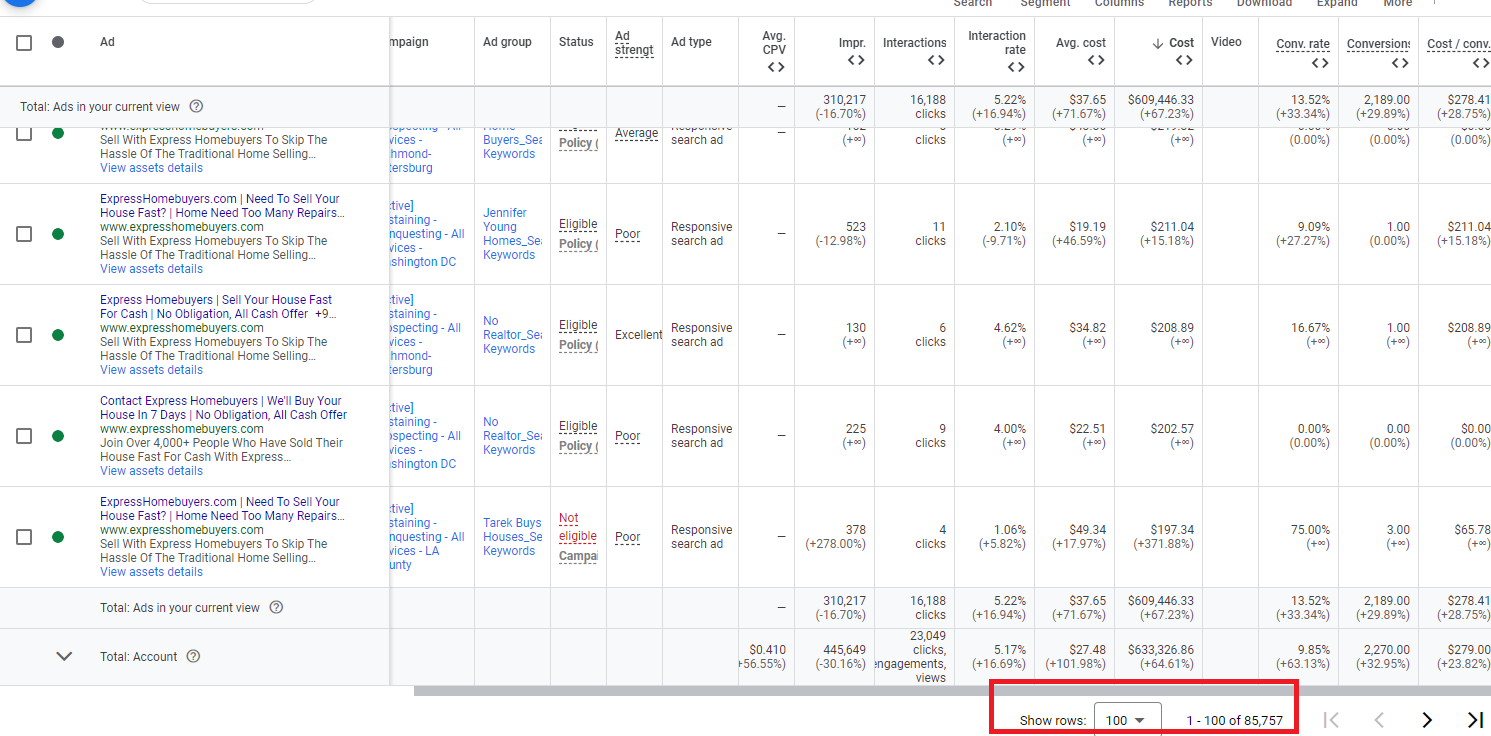

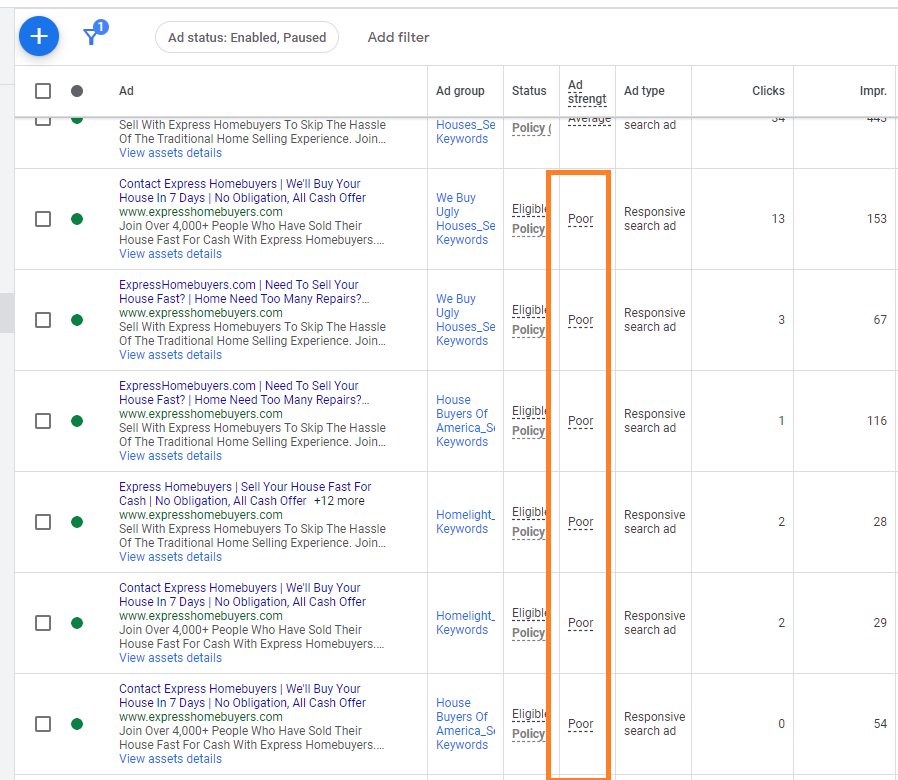

The vast majority of Ad spend, traffic generation and conversion production is coming from a handful of responsive search ads as screenshotted out below. Please Note there are over 85,000 Ads in the account.

Ad strength ranges from average to good for the Top 10 Ads, although we do see some poor -ranked Ads in the account as well.

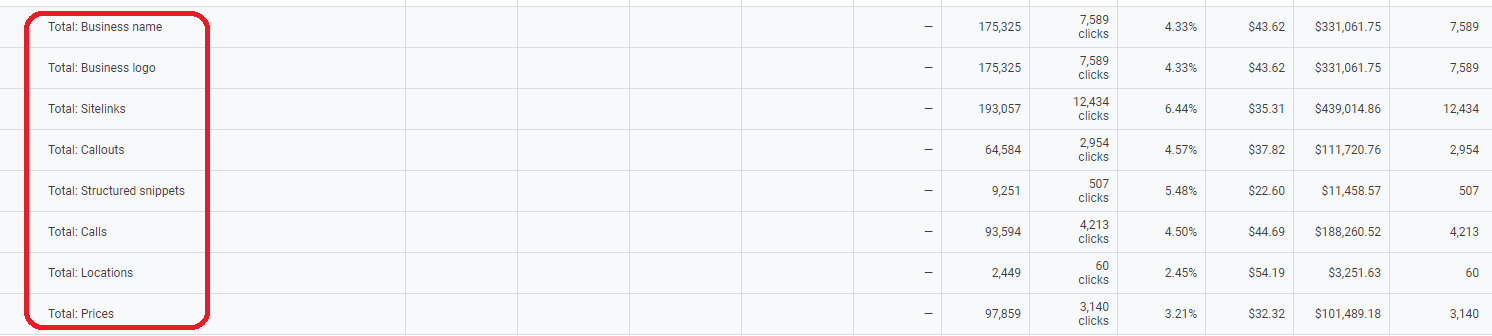

We also observed multiple assets being leveraged in the account, we see business name, business logo, sitelinks, call outs, Structured Snippets, calls, locations and finally prices enabled in the account.

Contact Music City Digital Media to take your campaigns to the next level.

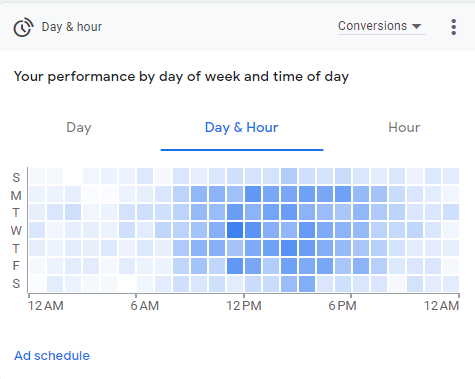

The account is set to GMT – 4, United States Eastern time. You can see from the Conversion data below that there is clearly a propensity for users to interact with your website and result in a conversion action between the hours of 8:00 a.m. and 8:00 p.m. Mondays through Saturday. This may represent an opportunity for you to increase your impression share and click through rate for users who are searching for your services during this time as your data indicates that those users are more likely to result in a conversion action during these times.

Contact Music City Digital Media to take your campaigns to the next level.

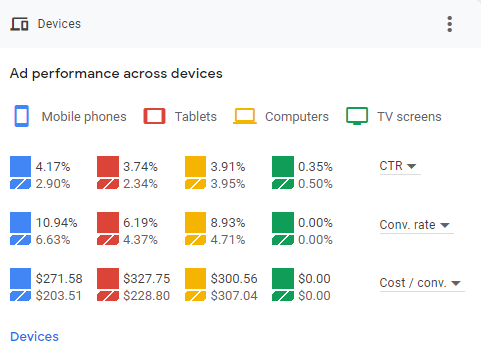

Device data indicates that the majority of Impressions clicks and conversions are coming from users on mobile devices. We see a very small percentage of users coming from tablets with the remainder coming over desktop devices. Click-through rate data for the different platforms is all very similar ranging from a low of 3.74% for tablets to a high of 4.17% for mobile devices. There’s not enough variation within these metrics to indicate a preference of one direction or another.

Looking at conversion rates however we do see a little bit more information that is usable. Conversion rates from users coming on tablets are at 6.1% compared to mobile devices at 10.9% in desktop devices at 8.93%. Finally, if we look at our relative cost per conversion they’re all in the ballpark of $300 plus or minus 10%.

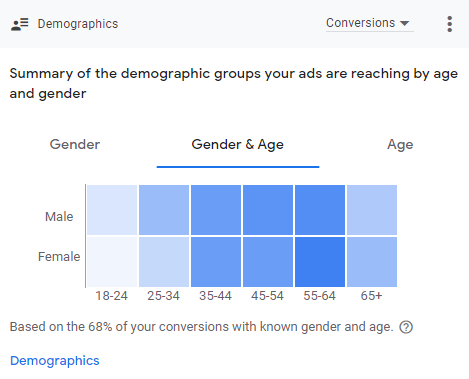

Audience data indicates that converting users are between the 55 to 64 age range with a relatively equal distribution between males and females. This is based on 68% of conversion data being known in the account.

Contact Music City Digital Media to take your campaigns to the next level.

This is an interesting time for conversion tracking for everyone in digital marketing. Obviously the switch over from Universal Analytics to Google Analytics 4 has provided its own unique set of issues and I would recommend setting up GA4 and utilizing the Google Tag for event tracking as that is the declared best standard from Google moving forward.

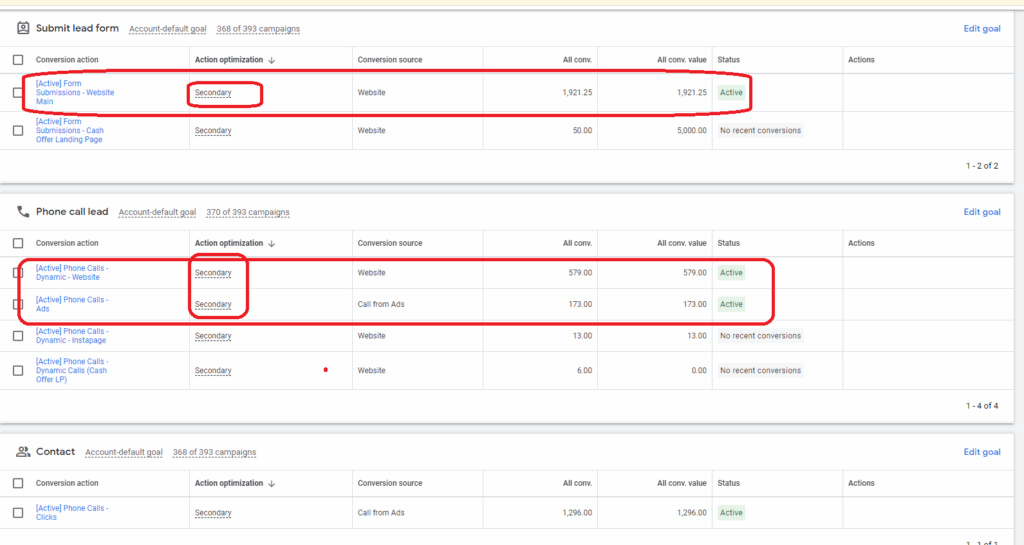

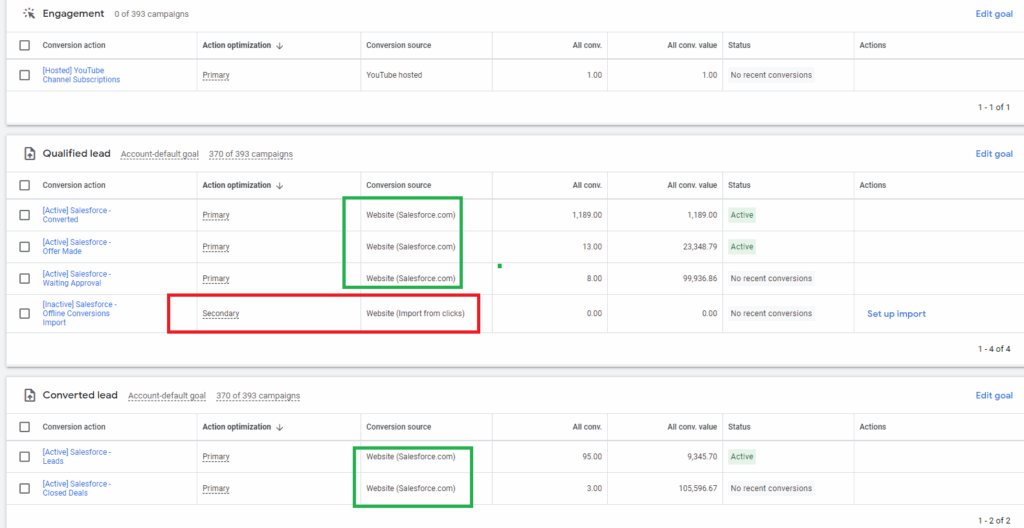

With that said I would still like to look at primary versus secondary conversion actions within the account. I have highlighted a couple of conversions in the account, one for web form submissions which is designated as a secondary conversion action as well as multiple conversion actions for phone calls happening from the search engine results page and directly from the website. In my opinion, these should be set as primary conversion actions because it’s critical that the system keep track of which users perform a primary conversion action and that this data is recorded in conjunction with them, so that this data can be leveraged back to the system and an effort to find more similar users who will also result in a conversion action later on down the line. This is a critical part of any automated bid strategy that leverages contextualized” black box” data as part of an automated bid strategy such as Maximize Conversions and its derivative strategies(TCPA,TROAS). Having these designated as secondary conversion actions is very detrimental toward a lead generation account.

It does also appear that there is a strong salesforce conversion tracking setup integrated into the account. I’m not sure operationally how you are set up and what your primary lead generation actions are. Best practices is to cover all of your bases and tracking conversion actions from website, CRM specific landing pages and any other multi-channel medium.

Contact Music City Digital Media to take your campaigns to the next level.