Structure & Bid Strategies – At present the account contains 8 Active Campaigns; 7 Search and 1 Display. No Active Display Remarketing has been found. Combined Daily Ad Spend is ~$815 per day for ~$24K/ Monthly Spend (CAD).

Campaign Status is variable from Eligible (Stable) to Limited by Policy to various levels of Disapproved Ads. This is a major issue with the account and needs to be fixed by resolving the errors or getting a Pharma/Cannabis exemptions put on the account.

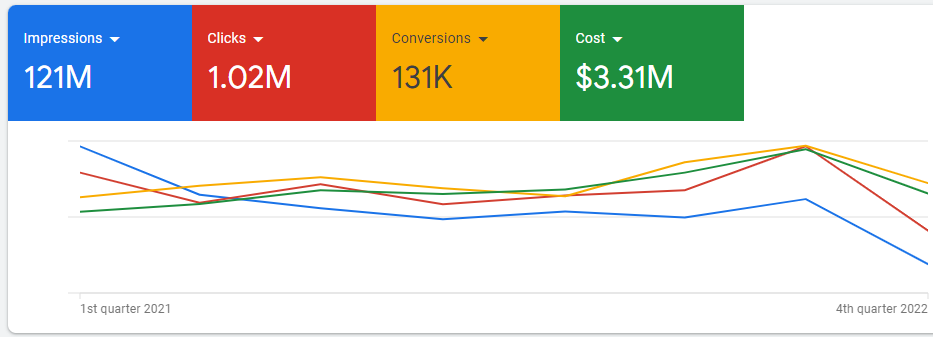

The account has generated 2.8 Million Impressions resulting in 27K Clicks to the website, generating 754 Conversion-Actions. CTR’s vary between a low of 0.03% and a high of 12.03%. Average Cost Per Conversion is $159 and a 2.73% Conversion Rate which is a typical rate for B2B accounts.

There are a variety of Bid Strategies being utilized with Max Conversions Target CPA In use in 7 of 9 active campaigns. Maximize Conversions and Target CPA are also being observed in the account. Target CPA is great for controlling your costs but it needs to be continuously evaluated as market conditions change.

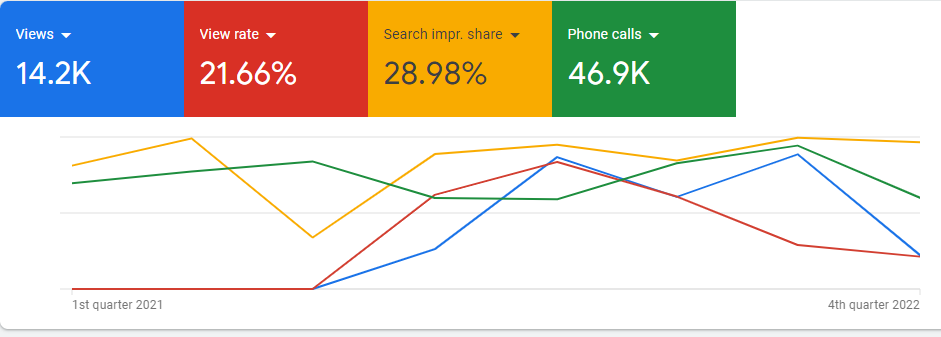

Impression Share indicates an ~48.56% impressions share within your primary geographic targets, which is a solid position to be in. You are outperforming CPROSolutions, Amazon and HowToHarvest.com. However, your absolute top of page rate, or how often you are in the undisputed #1 position is only at 47.96%. Typically we would see a 70-80% top of page rate with such a dominant impression share. This may be a result of TCPA Bid Strategies that are underpriced. We also see an extensive use of Google Search Partners.

. The Account average CTR is 0.90% but that should be considered a skewed result from the Display MDM Campaign which generated 2.4M impressions and 815 clicks at a 0.03% CTR. Removing this campaign from our analysis puts your CTR at a much more realistic and more PPC appropriate, ~6%.

Recommendations: Google’s automated flags and policy tools seem to be a major impediment to the account. Despite this annoyance, it is still producing leads, albeit somewhat inefficiently. Target CPA’s are set from $150 to $400 depending on Campaigns. TCPA is a great way at controlling costs for predictable accounts that have a mass market appeal. What we are doing here is applying to too small a market for TCPA bidding to be effective. We suggest switching to Maximize Conversions or MaxImize Conversion Value and Define value for PDF’s, Form Submits and Phone Calls. Going to Max Conversions will also help your absolute top of page rate by being more competitive in the auction process. We also recommend opting out of Google Search Partners which can waste budget. We also recommend putting all campaigns on the same Ad Schedule.

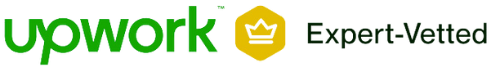

121M

1.02M

131,000

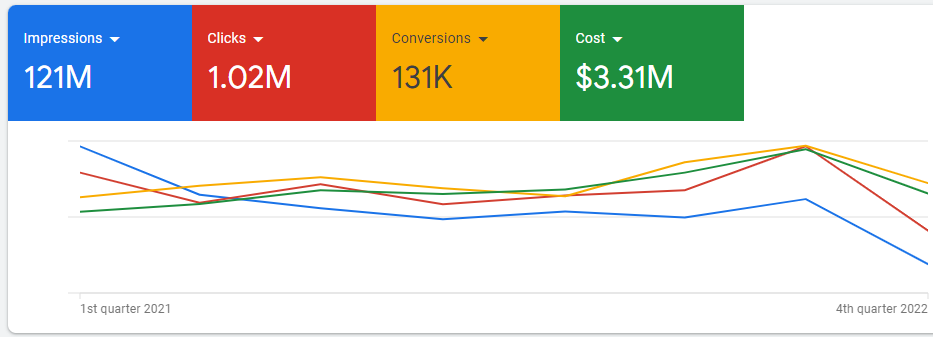

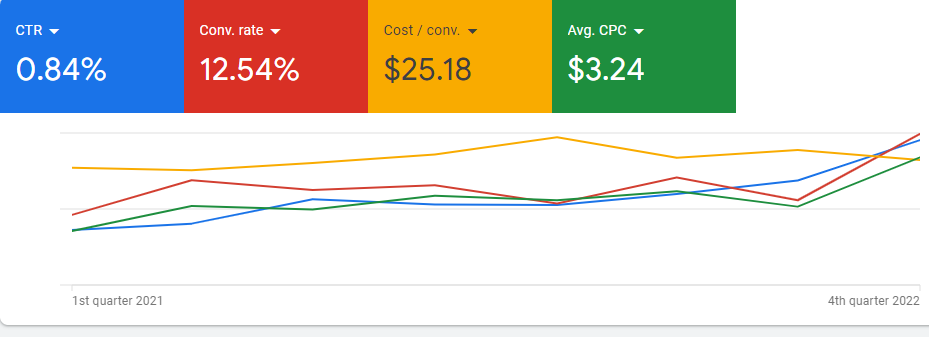

.084%

12.54

$3.24

$25.18

Contact Music City Digital Media to take your campaigns to the next level.

Device data is interesting. Impressions are split almost evenly across mobile and desktop, however mobile is receiving many more clicks than desktop (73% vs 24.6%). Contrast this data to the conversion data which indicated that 58.4% of conversions are coming from desktop. A quarter of your traffic brings in 50%+ of your leads.

Contact Music City Digital Media to take your campaigns to the next level.

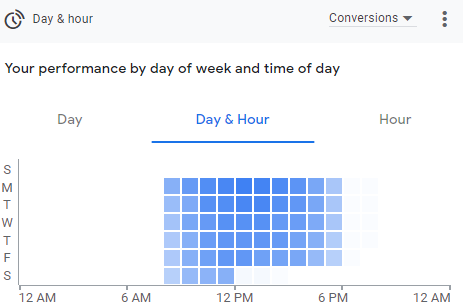

Location targeting is focused primarily on the US but we also see Canada in the Triminator Campaign. Ad Scheduling is in place on some campaigns but not all. If you look at the conversion data, those are happening over a pretty standard B2B schedule between 8AM and 8PM. By shifting our ad schedule to these times we are shifting impressions and clicks to produce more conversion during these times people are searching.

Contact Music City Digital Media to take your campaigns to the next level.

No Bid Adjustments have been found to be in use.

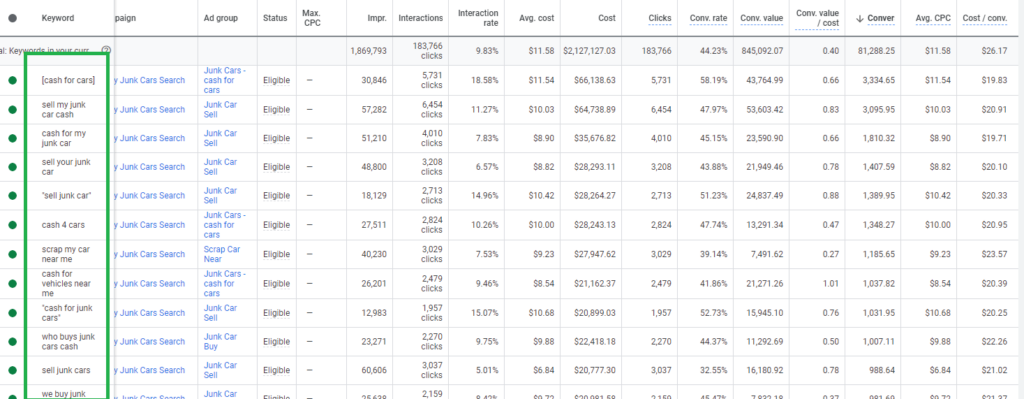

The Account contains 362 Keywords set to a combination of Exact, Phrase and Broad Match. By Conversion Volume the top performers are branded or branded and product-related terms. [Mobius Trimmer] has 302 and “Mobius Trim Machine” is next with 49.

Contact Music City Digital Media to take your campaigns to the next level.

73 Audiences using Observational Targeting were found in use on the account across a variety of campaigns. While it is good that we are using observational targeting, No bid adjustments for these audiences were found. Further, some audiences selected do not make sense with our desired goals. For Example, The Mobius M108S Trimmer Campaign has an In-Market Segment for Lawn Care & Gardening Supplies. This In-Market Segment is geared more toward people looking for weed-whackers and Miracle-Gro than industrial grade, high-production trimming machines.

88 Ads are found in the account with a variety of status levels ranging from Paused to Flagged for Policy Violations , Poor Ad Strength and Past Violations. Most ads are Expanded Text Ads which are being phased out in 2022 with a handful of AMPHTML ads. Legacy Ads are allowed to remain but we will not be able to create new ones. That is okay because Responsive Search Ads are the preferred way to use Search.

Contact Music City Digital Media to take your campaigns to the next level.

Google Analytics Remarketing Tag is not on the site and should be connected so we can build a complete list of everyone who visits the website from any traffic medium.

There were 55K Users to site with 77K sessions, indicating there is some repeat traffic. Bounce Rate is a realistic and normal 46% and average session duration is 1 Min 45 Seconds.

Analytics data indicates that ~35.5% of traffic is coming from Paid Search with another ~35% coming from Organic. 18% is coming direct with a variety of other traffic sources contributing ~10% of remaining volume. This is a website that is fairly reliant on paid traffic.

We are also seeing events being recorded in the Events overview section. Something called Clarity is recording over 58K events while Brochure is showing 5.1K , Forms 1.6K and More info 759. However, there are no goals defined in the account.

All Google Campaigns are being accurately recorded in

The account contains several conversion actions that are actively reporting data. We see Brochure Downloads, Form Submitted and Calls From Ads and Website.

Structure & Bid Strategies

Number of active campaigns has decreased to seven (6 Search, 1 Display)

Budgets have decreased significantly (CA$24k/month in 2021, $8k/month in 2022).

Most campaigns are limited in some capacity- by budget, by ads being disapproved, or by policy.

The Remarketing campaign in particular is showing as limited by past violation of policy for “Recreational Drugs”- with all recent appeals showing as Failed or Partially Successful. It appears that some progress has been made, but further appeals and/or compliance changes are still needed.

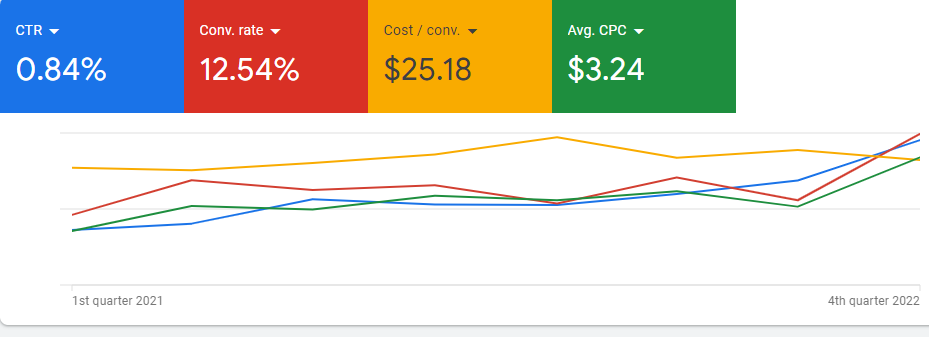

YoY, we’ve seen 15% more conversions in 2022 at a 15% decrease in spend- a nice boost in conversion rate efficiency.

Same time period comparison does show a 91% decrease in impressions, and 52% increase in cost-per-clicks- indicating there’s room for improvement here.

Still seeing nonuniformity with bidding strategies (mix of Maximize Conversions and Enhanced CPC’s)

For campaigns like the M1085 Trimmer, which has garnered 387 conversions YTD, a Max conversions strategy makes sense. For Hemp Sorting M9, with only 26, less so- the engine has less conversions (and bidding signals) for the machine to learn off of and optimize towards

Target CPA’s for Max Conversions campaigns are also different, ranging from $100 – $130. At what point are our products profitable? Let’s align on what our true target CPA should be!

Also location settings our set to English and Spanish for quite a few campaigns- why the latter? We don’t have Spanish-specific ad copy or landing pages.

Recommendations: We maintain our Target CPA recommendation with a Maximize Conversions strategy. Taking it a step further, we can utilize the Maximize Conversions Value strategy and assign values to PDF’s, fForm Submits, and Phone Calls. Campaigns set to Enhanced CPC strategy should be changed to Maximize Conversions (if sizable enough conversion numbers) or Maximize Clicks (if not).

121M

1.02M

131,000

.084%

12.54

$3.24

$25.18

Contact Music City Digital Media to take your campaigns to the next level.

Device data has become more pronounced. For all campaigns, computers outperform mobile and desktop by a significant margin. The M1085 Trimmer example below tells the entire story with exponentially higher conversion rates. Computer devices have spent less than mobile, but have garnered nearly double the conversions. Let’s add in some bid adjustments (empty 2nd column) to show up more frequently on computers and less so on mobile:

Contact Music City Digital Media to take your campaigns to the next level.

Location targeting is in the US.

and bid modifiers highly recommended. We have zero conversions YTD on a handful of days in the 7am-9am slot- let’s not show our ads then!

Conversely, weekdays from 11am-7pm are our top performing times by a significant margin. We should consider showing our ads more often (or even only) during these times:

Contact Music City Digital Media to take your campaigns to the next level.

No Bid Adjustments have been found to be in use.

Bid Adjustments are approved increases to our maximum bid in the google auction sequence for targeting criteria that better align with our idealized demographic profile. These include Location, Ad Schedule, Audience, Device and Conversion Type. By putting positive bid adjustments on the demo segments we want and negative adjustments on the ones we don’t want, we can guide Google’s AI to targeting the best user for our objectives. Look at that conversion rate for 25-34!

Household income also could use bid modifiers. We should implement a test to show our ads more frequently to higher earners, and less frequently to lower ones. The YTD data:

The Account now has 432 keywords, with only 285 active of all different match types. The top converters remain branded product-related terms. We’re spending thousands on currently active keywords such as “ bud trimming machine” which have garnered zero conversions YTD. Let’s weed these and other poor performers such as hemp mill (CA$256 CPA) out, and focus on further optimizing the keywords that have performed well, and discover new keywords for testing.

Contact Music City Digital Media to take your campaigns to the next level.

Quite a few audiences using Observational Targeting were found in use on the account across a variety of campaigns- without much rhyme or reason. We’re selling cannabis trimmers- why are off-road vehicles and commercial property audiences being observed?

Agriculture, Home & Garden, Engineering, and In-market for business and industrial products are some audience segments we currently are not observing, but should be (then later targeted and bid adjustments added as per their performance. Note- view performance data for Commercial Properties & Off-Road Vehicles.

many ads have improved from “Poor” to “Good” or “Average” (great!) but still work to do to get as many of these to Good/Excellent as possible to help increase our Quality Scores and lower our costs. Also, can we add in Price or Promotion Extensions? The more SERP real estate the better!

Contact Music City Digital Media to take your campaigns to the next level.